Financial Literacy

Learning more about personal finances is the first step toward becoming debt-free

What is Financial Literacy?

Financial literacy is your ability to understand basic finance and a range of different financial topics. Many people informally gain financial literacy throughout their life as they learn different aspects of day-to-day finance. As a result, most people improve their financial literacy by trial and error and this means they are only learning something new about finance when they have an issue or need to address a financial need.

Why is Financial Literacy Important?

Learning by trial and error when it comes to finances is dangerous because you are putting your money at risk. If you get something wrong, you may face problems paying your bills, covering monthly expenses and making sound investments. You may also damage your credit, which can prevent you from getting a new home, buying a car, and reaching your other financial goals.

A much better strategy is to take steps to improve your financial literacy now. This gives you time to really understand financial topics without the urgency of having something you need to do. You can take time to appreciate the importance of personal finance and make more educated choices about how to achieve your goals.

Improving Your Financial Literacy

Below you’ll find a description of four essential financial literacy topics. You can start your journey with our Financial Literacy Month 30-Day Check List. No need to wait till November, Fin Lit should be a year-round quest. Get the family and kids involved, start good financial habits early. If you would like to dive deeper into our educational material, check out our Financial Advice section. If you have questions or need help, call Consolidated Credit at 1-888-294-3130 or take the first step online with a request for a Free Debt Analysis.

1. BUDGETING

Accurate household budgeting is the foundation of a healthy financial outlook. Some consumers try to keep everything organized in their head, but many find that writing things down, setting budget goals, and tracking spending are essential parts of financial stability. An effective budget strategy doesn’t limit you. Instead, it helps maximize your financial potential so you can achieve your financial goals.

| What Your Gain with a Budget | What You Lose with a Budget |

|---|---|

| A complete picture of your monthly spending. | Stress over how much money you have at any given time in the month. |

| An easy way to measure your debt-to-income ratio and the ratio of your monthly credit card payments versus your income. | The increased likelihood your debt will begin to exceed what you can afford at your income level. |

| The ability to make savings a line item in your budget, which increases your chances of actually saving effectively. | Leaving savings as whatever you have left over at the end of the month. |

| A means to see how much of your income goes to various types of expenses. | Confusion over where all of your income goes in any given month. |

| The ability to make accurate financial assessments prior to making large purchases. | The need for guesswork when it comes to making large purchases. |

What Financial Experts Say about Budgeting

In addition to saying that you need a budget, financial experts agree you should check your budget every six months. As well, you should review your budget any time there is a significant change in your income or your expenses. If you get a new job with a different salary, move to a new house with new utility costs, or buy a new car with different gas mileage, you may need to review your budget so it reflects your real spending.

Budgeting Resources from Consolidated Credit

You can use the following resources to help you create and manage your household budget:

2. SAVING

Savings is important – far more important than the priority most consumers give savings as part of a stable financial outlook. In order to be financially successful, you need to save money and have an effective strategy in place for how and where you save. With the right strategy, you can build a healthy savings plan, no matter your income level or social standing. Savings will help you plan for your family’s future and reach your financial goals.

Developing an Effective Saving Strategy

Building savings effectively doesn’t require large sums of money. It only requires a commitment to saving consistently. This allows you to build savings over time even with limited cash contributions.

| If you have an account that offers 5% interest (yield), in ten years… | ||

|---|---|---|

| $/day | $/week | Yield |

| $1 | $7 | $4,720 |

| $2 | $14 | $9,440 |

| $3 | $21 | $14,160 |

| $4 | $28 | $18,880 |

| $5 | $35 | $23,600 |

| If you have $1,000 to save per year ($19.20 every week)… | ||||

|---|---|---|---|---|

| Interest Rate | 5-yr. Yield | 10-yr. Yield | 15-yr. Yield | 20-yr. Yield |

| 5% | $5,525 | $12,578 | $21,578 | $33,065 |

| 6% | $5,637 | $13,181 | $23,276 | $36,786 |

| 7% | $5,751 | $13,816 | $25,129 | $40,995 |

| 8% | $5,867 | $14,487 | $27,512 | $45,762 |

| 9% | $5,985 | $15,193 | $29,361 | $51,160 |

| 10% | $6,105 | $15,937 | $31,772 | $57,257 |

| 11% | $6,228 | $16,772 | $34,405 | $64,203 |

| 12% | $6,353 | $17,548 | $37,279 | $75,052 |

Savings Resources from Consolidated Credit

The following resources can help you develop an effective saving strategy and find more savings in your household budget:

3. DEBT

Not all debt is bad debt and debt can be an important part of a healthy financial outlook. It allows you to build credit, purchase assets such as a home or car, shop online, and achieve your financial goals. Without debt, you could only use cash to make purchases on the spot. The key is to use debt strategically and manage your debt in a way that doesn’t put your finances at risk.

Do You Control Debt or Does Debt Control You?

The most important aspect of dealing with debt in a healthy financial outlook is to maintain control over your debts. When debt is in balance with your income and your budget, it provides certain advantages in your personal finances:

| When Debt is in Control | When Debt is Out of Control |

|---|---|

| You enjoy lower interest rates on new debts, including your mortgage and car loan. | Your interest rates are higher, and your debt costs you more. |

| You save money on interest payments. | You pay more money in interest charges. |

| You can structure your debts to pay them off faster and more effectively. | You struggle to keep up with your bills. |

| You have money left over in your budget for an effective saving strategy. | You reduce your cash flow and lose the ability to save over time. |

| You have better credit scores. | You have bad credit. |

Debt Resources from Consolidated Credit

The following resources can help you manage your debt effectively so you can avoid financial distress caused by debt:

- Free Online Debt Quiz

- Free Online Debt-to-Income Ratio Calculator

- Free Online Debt Payment Calculator

- Free Online Mortgage Calculator

- Free Debt Analysis

4. CREDIT

Credit and your credit scores are important parts of your financial outlook. Excellent credit allows you to take advantage of the best offers on credit cards and get the lowest interest rates on things like your mortgage and auto loan. Bad credit means you face higher interest rates and will pay more money over the life of your debts. Even having no credit if you avoid using credit cards and taking on debt does you a disservice, because you may be denied for apartment rentals and car rentals, as well as employment in certain industries.

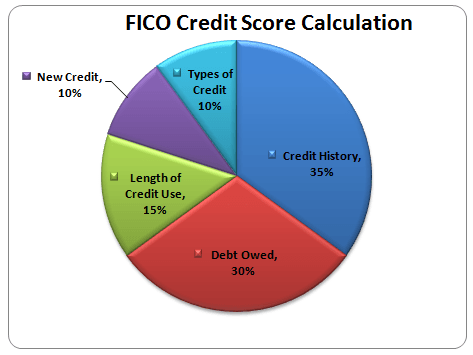

Understanding Your Credit Scores

Your credit and credit rating are both largely dependent on your credit scores. The following chart shows how your credit scores are calculated:

Credit Resources from Consolidated Credit

The following guides will help you develop your credit profile so that you can use credit effectively and maximize your credit scores:

Equipped with the proper tools to understand your financial situation, you can start making the necessary moves to reduce debt, build savings, and invest in your future. Work your way to a better outlook with our 30 days checklist. However, sometimes our debt is beyond our control and we need a helping hand. Give us a call at 1-888-294-3130 to speak to a trained credit counsellor today, or try our Free Debt Analysis online.